If you are dealing with medical debt, struggling to afford your insurance deductible while paying for medical expenses, or have delayed a major medical procedure due to its cost, let us know in our survey.

About the Author

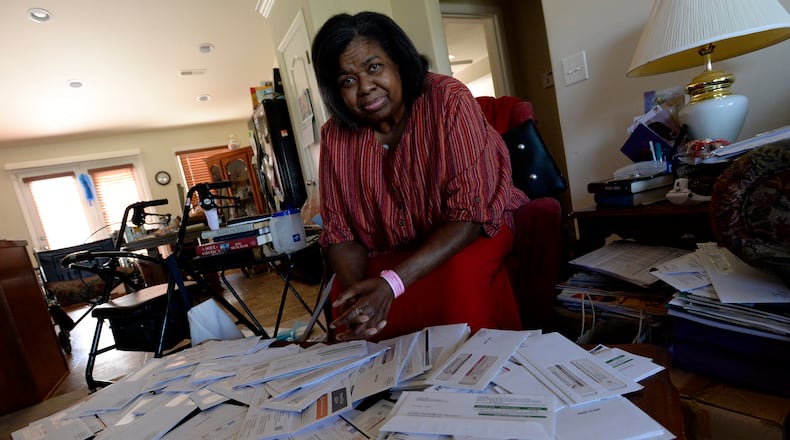

Credit: Mark Zaleski

Credit: Mark Zaleski

Cost barriers can cause individuals to delay or go without medical care as research has found that medical indebtedness is common, even among the insured, and most households between 150% and 400% of the federal poverty level cannot afford a typical family deductible of $12,000.

A recent investigation in the Journal of the American Medical Association looked at how medical debt is associated with subsequent worsening of social determinants of health, such as housing and food security. According to the investigation, acquiring medical debt was a risk factor for becoming food insecure, losing the ability to make rent or mortgage payments, being unable to pay for utilities, and being evicted or dealing with foreclosure.

If you are dealing with medical debt, struggling to afford your insurance deductible while paying for medical expenses, or have delayed a major medical procedure due to its cost, let us know in our survey.

About the Author