Income tax makes up over 80% of Springfield’s general fund, which is estimated to be around $55 million for 2023, according to a presentation recently that highlighted the city’s tax budget for next year.

The portion of income tax that makes up general fund revenues have continued to increase going from making up 75.24% of general fund revenues in 2014 to now expecting to make up 81.37% of those revenues in 2023.

Income tax collections have been increasing over the years. The only exception was during 2020 as annual income tax revenues went from $36.4 million in 2019 to $35.6 million in 2020 due to the economic impacts of the coronavirus pandemic.

However, income tax revenues increased to 39.9 million in 2021.

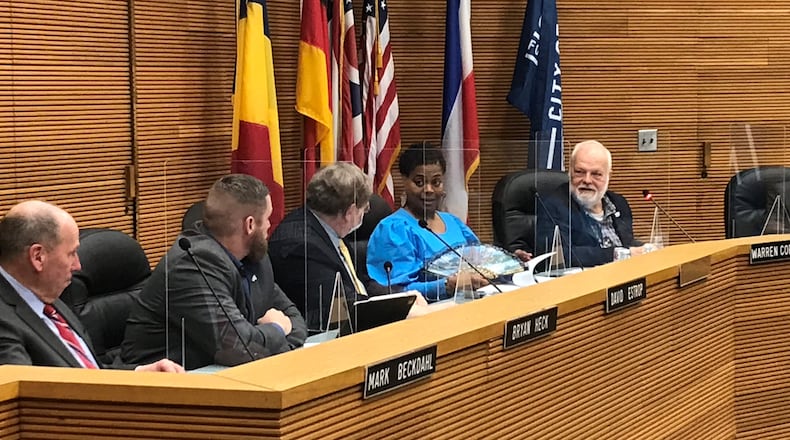

That information was shared to Springfield city commissioners recently by Mark Beckdahl, the finance director for the city of Springfield. An ordinance to adopt the tax budget was also approved by elected officials during their bi-weekly public meeting on Tuesday.

Projected tax revenues is part of larger discussions related to what the city’s overall budget will look like in 2023. City officials will be looking at expected expenses in the near future and the overall budget for 2023 is expected to be presented by the end of this year.

“It is awfully early in the year to be focused on expanses. We will be talking about those throughout the summer,” Beckdahl said during his presentation to city commissioners.

In addition, to income tax revenue projections, Springfield also expects an additional $3.8 million in general fund revenues to come from fines, licenses and charges for services that are administered by the city.

Local government funds are expected to add $2.4 million in general fund revenues for that year, representing an increase when compared to what is projected for this year, Beckdahl said.

Springfield is expecting total revenues related to major operating and capital funds to total at about $104.3 million for 2023. Projected general fund revenues will make up 53%. Other revenues outside of the general fund, include $31.4 million from the city’s utility funds, $7.8 million from permanent improvement funds, $4.2 million from the city’s street funds and $3.5 million from the Special police levy.

About the Author