In the state’s 2019 transportation budget bill, Ohio fuel taxes went up from 28 cents per gallon for both gas and diesel to 38.5 cents on gas and 47 cents for diesel.

State Sen. Steve Huffman, R-Tipp City, introduced Senate Bill 277 on Dec. 14. It would cut the fuel tax back to 28 cents per gallon for both gasoline and diesel for five years, then return the tax to its current level.

It would also suspend for five years collection of the additional registration fee for hybrid or electric vehicles: $100 a year for hybrids, and $200 for electric vehicles.

“The premise of the bill is, the federal government in the infrastructure bill will give the state of Ohio $11.5 billion in the next five years,” Huffman said.

Over that same period, the tax on gas and diesel would generate $1.5 billion, which is what the state anticipated having for road and bridge projects, Huffman said.

Because the federal money is far greater, his bill seeks to give that $1.5 billion back to taxpayers, he said.

Truckers are particularly displeased that their fuel is taxed at a higher rate than gasoline, Huffman said. But because much more gas is sold than diesel fuel, the receipts from the gasoline tax are six times the receipts from diesel taxes, he said.

The federal infrastructure bill passed in November includes $9.7 billion for Ohio roads and bridges specifically. Huffman said he plans to amend his Ohio Senate bill to ensure local jurisdictions get as much road money from the federal infrastructure funds as they would have from the gas tax.

In 2020, Montgomery County and all its political subdivisions shared a total of $26.6 million from state fuel taxes, according to Ohio Department of Taxation figures. That included $3.6 million for the county itself and $5.6 million for Dayton.

Gov. Mike DeWine has spoken against cutting the gas tax. His press secretary Dan Tierney offered no direct comment on Huffman’s bill but said the governor’s office is reviewing it.

When DeWine pushed for the motor fuel tax increase to fund road construction and offset fuel tax losses from COVID-19-related declines in driving, it was done largely out of concern for road safety, Tierney said.

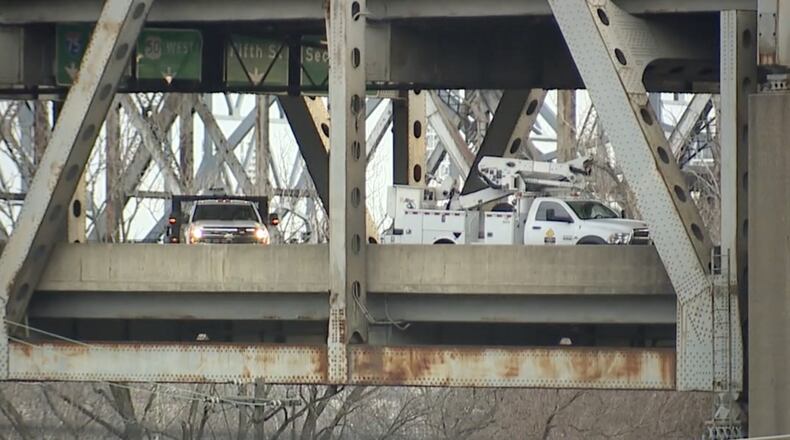

“Of course, that included major bridge projects like the Brent Spence Bridge,” he said.

In general, legislation that seeks to use a unique funding opportunity — such as the infrastructure bill — for long-term needs would be a matter of “concern,” Tierney said.

“It’s just wise not to fund ongoing operations with one-time funds,” he said.

The first impact of lowering fuel taxes would be on projects the state Transportation Review Advisory Council has already approved and ranked through 2025, said Matt Bruning, statewide press secretary for the Ohio Department of Transportation.

“Any reduction in revenue would significantly reduce ODOT’s ability to maintain and improve our roads and bridges,” he said.

Projects in that plan recommended for construction in the Dayton region include:

· In Greene County, building a new interchange at U.S. 35 and Valley/Trebein Road, a $36 million project.

· In Warren County, widening state Route 63 from Union Road to state Route 741, a $33 million project.

Dayton-region projects recommended for design in that period include:

· In Montgomery County, improvements to North Dixie, Northwoods and Lightner roads, a $17 million project.

· In Montgomery and Greene, improvements to the Interstate 675 and Wilmington Pike interchange, a $63.4 million project.

· In Butler County, creation of an east-west route, including a new river crossing in north Hamilton, a $106 million project; and a new interchange at Interstate 75 and Milliken Road, a $27 million project.

Fuel taxes — both state and federal — pay for the majority of road and bridge work in Ohio and other states.

In February 2021, the annual ranking from the Ohio Council of the American Society of Civil Engineers gave Ohio’s roads a D and its bridges a C+, citing inadequate funding for local repairs.

Ohio has had a gas tax since 1925. It was 28 cents per gallon in 2005, where it stayed until July 1, 2019. At that time the state added a flat annual fee of $200 for electric cars and $100 for hybrids, also to go toward road maintenance in lieu of taxes on fuel.

The federal fuel tax has remained at 18.4 cents per gallon for gasoline and 24.4 cents for diesel since 1993.

The state’s hybrid/electric vehicle fees are a “very small portion” of vehicle tax revenue, but Huffman said he wanted to be consistent in undoing all of the 2019 tax hike.

“If the General Assembly wants to add that back in, I don’t think it would be that bad of an idea,” Huffman said.

About the Author