BWC impact

The Ohio Bureau of Workers’ Compensation in fiscal 2012:

- Provided coverage to more than 252,000 employers

- Received premiums and assessments from employers totaling more than $2 billion

- Processed more than 116,000 new claims

- Paid out $1.9 billion in benefits

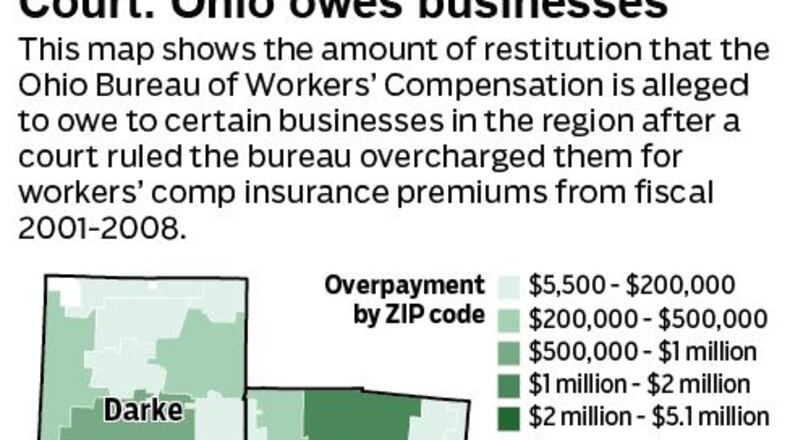

The Ohio Bureau of Workers’ Compensation knowingly created an inequitable system of setting premiums for workers’ comp insurance that resulted in overcharges to hundreds of thousands of Ohio businesses between 2001 and 2008, according to a judge’s ruling in a class-action lawsuit.

A March 14 hearing in Cuyahoga County Common Pleas Court will finalize restitution amounts involving 270,000 business across the state. Based on an accounting method ordered by the court, the plaintiffs estimate the amount of overcharges at $860 million. The Bureau of Workers’ Compensation, or BWC, denies that it owes any restitution and vows to appeal.

A Dayton Daily News analysis of spreadsheet data filed in court late last month by the plaintiffs shows that, if the court’s Dec. 28 ruling withstands appeals, the BWC will owe $81 million, minus attorney fees, to nearly 29,000 businesses in Montgomery, Miami, Greene, Warren, Butler, Clark, Preble and Darke counties. That’s an average of more than $2,700 per business.

Plaintiffs’ attorney James DeRoche of Cleveland said the restitution will put money in the hands of many small businesses across the state, “boost the Ohio economy and probably help with the employment situation.”

BWC officials say they’ll appeal regardless of the outcome of the March 14 hearing before Judge Richard J. McMonagle in Cuyahoga County Common Pleas Court. “We continue to maintain that our actions were lawful and the plaintiffs’ complaint is without merit,” said BWC spokesman Bill Teets.

Suit filed in 2007

The plaintiffs, led by Cleveland-area restaurant owner San Allen Inc. and other Cuyahoga County businesses, filed suit in 2007, arguing that BWC overcharged employers that were not enrolled in group plans. The lower premiums for those plans are based on proven safety and loss-control practices.

However, the non-group businesses argued that they were forced to pay exorbitantly high rates to subsidize premium discounts of as much as 90 percent for businesses in group plans offered by sponsors like the Ohio Chamber of Commerce, the Ohio Manufacturing Association and the Ohio Farm Bureau.

They said there was no evidence the non-group businesses were less safe than those covered by group plans.

In Ohio, all employers must have workers’ compensation coverage through the state or be self-insured. Workers comp insurance pays out when employees are injured on the job.

The lawsuit covers fiscal 2001-2008. The BWC has since limited discounts to a maximum of 53 percent and offers new programs to reward employers with good safety records.

McMonagle ruled that BWC officials knowingly created an inequitable system of charges. Evidence presented at an Aug. 20 bench trial, the judge noted, indicated the BWC’s own consultant reported in 2004 that there were “huge surcharges imposed on non-group businesses,” and “the BWC admits that the base rates paid by non-group employers were greatly inflated during each of the policy years and resulted in inequity.”

DeRoche said the BWC dismissed some employers from group plans after having a single workers’ comp claim.

“It didn’t matter if it was their fault or not. They went from paying 5 percent (of the standard premium) to 125 percent,” he said. “Sixty-five hundred employers would get kicked out of group every year, and 2,500 of them would go out of business because they couldn’t handle the rate. It was insane.”

DeRoche also said the BWC can afford to pay the $860 million because it has $8 billion in reserves, a figure the the state agency disputes.

Teets said most of the reserve money, $7 billion, represents the assets in the state’s insurance fund. That money is held in trust so BWC can meet workers’ comp claims that can pay out over a period of decades, regardless of investment-market conditions or the volume of new claims, he said.

“It shouldn’t be viewed as a surplus. We have what is known as a long claims tail.”

No windfall

For most businesses, the restitution amounts will be relatively small. Out of a class of 300,000 businesses, 29,000 aren’t eligible for any restitution, and another 18,000 would get $5 or less. Half of the businesses would be eligible for less than $200, and 75 percent would get less than $1,000, Teets said.

The largest single restitution amount statewide is for more than $2.1 million, and the biggest one in the Miami Valley is $1.6 million, owed to a Huber Heights company, according to the plaintiffs’ calculations. The names of the companies are not made public in court filings, which refer to them only by their policy numbers. McMonagle instructed the plaintiffs to calculate the restitution amounts using a specified accounting method.

BWC General Counsel Sarah Morrison couldn’t say whether the non-group employers provided less safe workplaces than group employers, but they “certainly had higher claims costs,” resulting in claims costs of $1.26 for every $1 in premiums they paid during the period covered by the lawsuit.

Teets said the non-group employers’ claims costs were $861 million more than the premiums they paid during the period, and BWC’s net assets decreased by $2.5 billion.

“We don’t believe the plaintiffs suffered any harm that entitles them to restitution,” Teets said.

About the Author