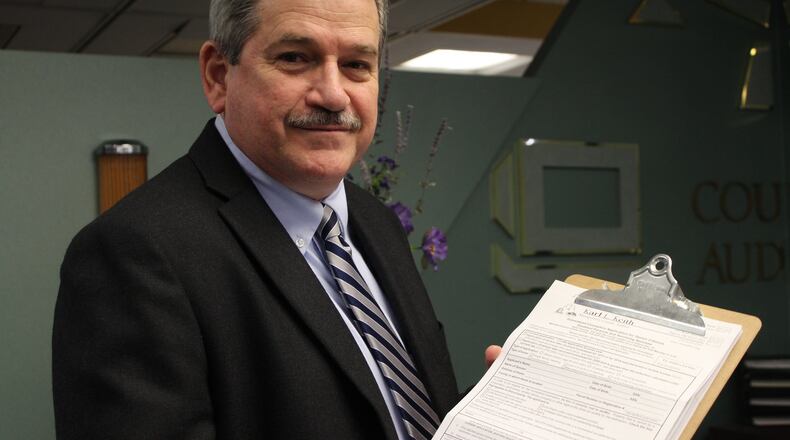

Changing the bill so dramatically at its final hearing left little opportunity for review or comment by affected parties, Montgomery County Auditor Karl Keith said.

“This just isn’t an effective way, I don’t believe, to make legislation on such a complicated and important issue,” he said.

The Ohio County Auditors’ Association would like to have more input on what sort of appeal process would work most efficiently, said Greene County Auditor David Graham

“It just really didn’t get vetted well,” he said of the altered bill. “It’s an overreaction to a small problem.”

In its original form, HB 126 would have required school districts to pass a resolution before challenging a property tax valuation. It also would have required the districts to notify the affected property owners of the challenge.

Each county’s Board of Revision, consisting of the county auditor, treasurer and commission president or their representatives, hears challenges to property tax valuations.

State Rep. Derek Merrin, R-Monclova Twp., introduced the bill in February and it passed the House by a 62-31 vote in April. It moved on to the Senate Ways & Means Committee, where it got five hearings. Throughout its committee hearings, the bill was generally backed by realtors, businesses and apartment owners, and opposed by public school systems.

But at its fifth hearing on Dec. 7, an amendment changed the nature of the bill.

Now it prohibits anyone filing a property tax complaint with a Board of Revision, unless that person or entity owns the property in question.

That would prevent school districts from challenging valuations on other property, and schools could only file a response to an owner’s complaint if the school board passed a resolution to do so. When a Board of Revision has ruled, the school district could not appeal, the legislation says.

It also forbids a school district and a property owner from making a “private pay” agreement, in which the property owner pays the district not to challenge a valuation; but doesn’t prohibit a new valuation agreement if it’s reflected on the tax list.

The full Senate approved the amended bill Dec. 15 by a 24-7 vote. During the Senate debate, state Sen. Louis Blessing, R-Colerain Twp., chair of the Senate Ways & Means Committee, said the current process is “stifling economic development” and that the change would bring “balance.”

Democrats opposed the bill, with state Sen. Nickie Antonio, D-Lakewood, saying the appeal process needs some “guardrails” but that the substitute bill goes too far.

Now the House must agree to the amended version or a conference committee will need to reconcile the differences before it can be sent for Gov. Mike DeWine’s signature.

The House is not scheduled to meet again until Jan. 19, leaving some time for legislators to take note of auditors’ objections.

Rep. Merrin, the bill’s sponsor, was not immediately reached for comment.

The Ohio county auditors’, county treasurers’ and county commissioners’ associations sent a joint memo to Senators on Dec. 14, urging them to send the bill back to committee. County auditors sent a separate, similar letter as well.

The original bill would have been “a welcome improvement to the local process,” but barring valuation challenges would ultimately hurt all taxpayers by lowering the total tax base, meaning higher overall rates, the auditors’ letter said.

Most cases reviewed are complex commercial-industrial properties, or investor-owned apartment complexes, it said.

“Cases against owner-occupied residential parcels are incredibly rare,” auditors wrote.

As of Friday, Keith said, he had not heard any response from Senators. County auditors have continued discussing strategy and hope to agree on an effective, unified approach before the House reconvenes, he said.

Keith said he thinks auditors would be willing to talk compromise, but that school boards have played a positive role in property valuation and auditors want to see that continue.

It’s very useful for the Board of Revision to look at individual sale details and all aspects of a particular property, and that’s where additional research by school districts can be a big help, he said.

Speaking to more than 60 local government officials during his Auditor’s Annual Update on Dec.16, Keith said that in 2021, school districts challenged 224 assessments in Montgomery County, resulting in an increase of $94.8 million in assessed value. Of those challenges, more than 92% were filed on commercial properties.

Because county auditors have so many properties to evaluate, they use a statistical approach to adjust an area’s overall values in light of recent sales, Graham said.

Greene County, for example, has 76,000 parcels of property, making it impossible to individually appraise them all, he said.

“This is a great approach for residential properties, but on commercial properties it doesn’t work really well because every commercial property is different,” Graham said.

One way real valuations of commercial property can escape auditors’ notice is the “LLC loophole,” he said. If a limited liability corporation owns a property, and LLC itself is sold, the value of that sale wouldn’t show up in property sale records because the property itself didn’t technically change hands.

About the Author